Investment Outlook: Balancing the West Side Story with the East Side Story

A monthly round-up of global markets and trends

A monthly round-up of global markets and trends

Financial markets are echoing West Side Story’s rivalry, with US tech giants dominating the West Side and emerging markets (EM), led by China, rising on the East Side. EM equities are outperforming those in developed markets (DM) so far this year, driven by stronger earnings, a weaker dollar, and improving Chinese valuations. Structural shifts and artificial intelligence (AI) momentum suggest EMs may continue to challenge Western market dominance.

Just as the iconic musical West Side Story dramatised the rivalry between the Sharks and Jets on the streets of New York, today’s financial markets are witnessing a clash between two sides: the West Side, dominated by US large-cap tech giants like Microsoft and Nvidia, and the East Side, led by emerging markets, particularly Chinese companies like Tencent. While headlines focus on record highs in US tech stocks, emerging market equities are quietly staging their own breakout performance. The MSCI Emerging Market index is up nearly 20% year-to-date in US dollar terms, comfortably outperforming the MSCI Developed Market benchmark - which includes the US, UK, and EU - at 14%.1

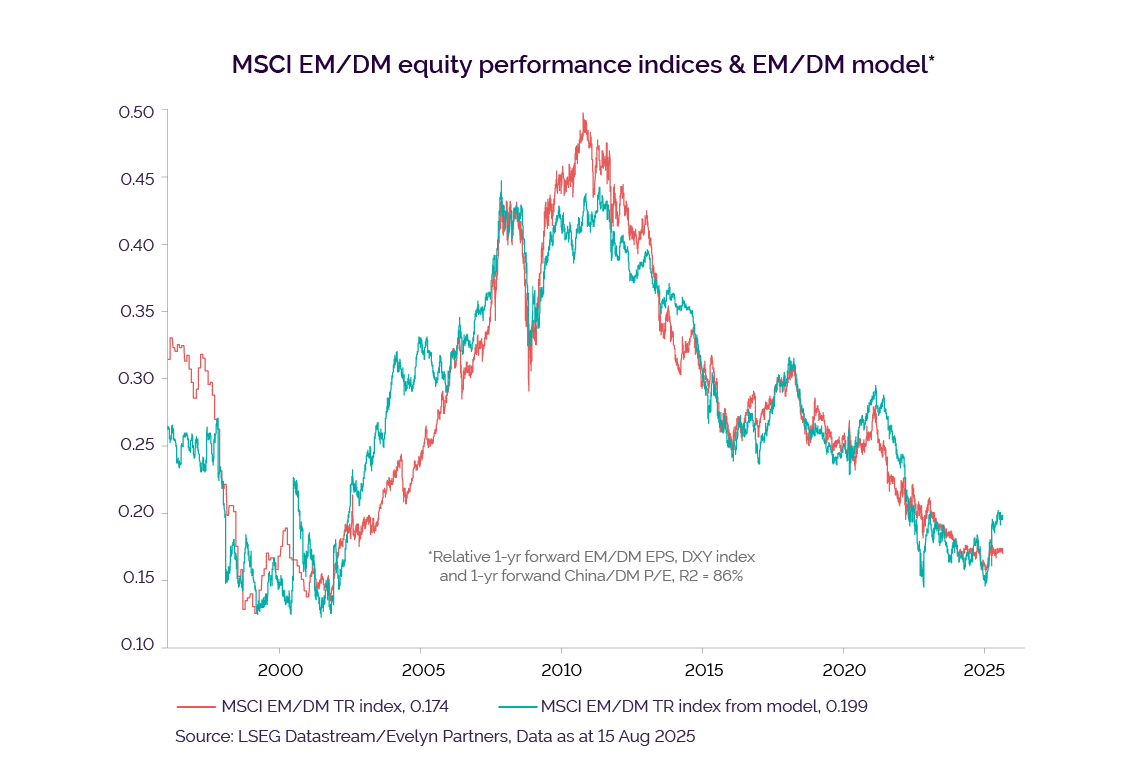

To understand what drives the performance of EMs relative to DMs we looked at data going back 30 years. Our analysis found that earnings, a weaker US dollar and Chinese equity valuations explain more than 80% of the relative returns of EMs.2 We discuss the outlook for each of these drivers below and find that there is room for EMs to continue outperforming DMs.

Over the long term, earnings-per-share (EPS) growth in EMs has generally been slightly higher than in DMs. Currently, analysts forecast one-year forward EPS of 12% in EMs and 11% in DMs.3 There are reasons to believe that EM can continue to deliver faster growth over DMs in the next few years.

First, countries like India and Saudi Arabia are supported by structural drivers, like favourable demographics and diversification away from fossil fuels, respectively. For instance, India’s population is not expected to peak until 2050-2060, and this is set to remain a key driver of future economic growth.4 Importantly, India has a decent track record of translating output growth into EPS.

Second, strong global demand for AI is lifting semiconductor sales, particularly in Taiwan and South Korea. Leading chipmakers like TSMC and Samsung are seeing rising orders for advanced processors, fuelling EPS growth and reinforcing their strategic role in the AI supply chain.

Third, historically, EM companies have relied heavily on new equity issuance to finance growth, leading to persistent share dilution and a drag on EPS. However, the Chinese regulator has imposed tighter controls on companies to curb share issuance through Initial Public Offerings and secondary issuance, and companies are increasingly buying back their own shares. Considering both the shares being issued and bought back, there is now a so-called positive net buyback yield for EMs that has turned positive for the first time since 2004, and it is now a contributor to higher EPS growth.

Ironically, President Donald Trump’s stance on trade protectionism has had a positive impact on the economies of large exporting nations, like China. That’s because its prompted policy support and encouraged export diversification away from the US. In July, the IMF revised up real GDP growth in EM economies by 0.4 percentage points from its April projection to 4.1% in 2025, and by 0.1 percentage point to 4.0% in 2026.5 These revisions were led by China, which saw the largest upward increases among major economies.

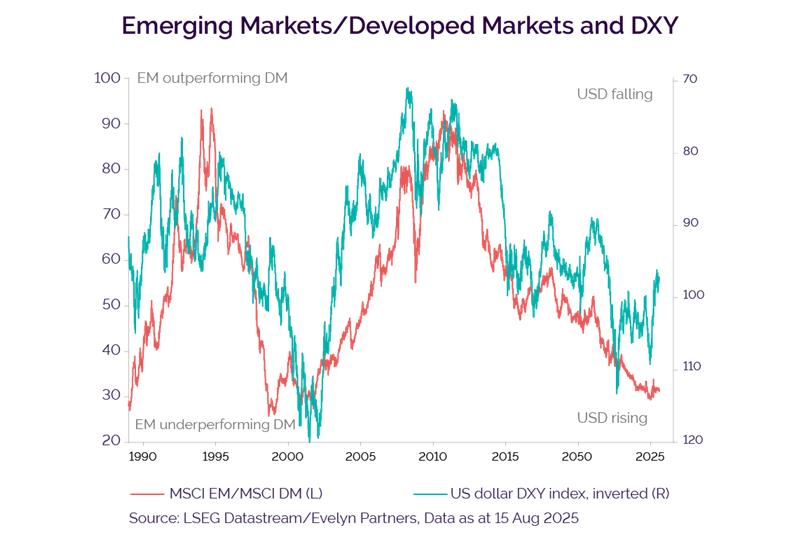

By improving growth prospects outside the US, the dollar has weakened, as some money has flowed to countries on the expectation of relatively better returns. In other words, investors have hedged their bets against US exceptionalism by parking capital in non-US markets.

In the short term, Trump’s pick of the next Fed chair is also having a dampening impact on the US dollar exchange rate. His repeated criticism of Federal Reserve Chair Jerome Powell for not lowering interest rates has indirectly led to a softer dollar.

A weaker dollar is generally positive for EMs. That’s partly because they owe over $12 trillion (~30% of EM GDP) in gross external debt that is largely denominated in US dollars.6 A softer dollar makes this debt easier to service, reduces the risk of default, and supports economic and earnings growth. This allows for a higher valuation to be placed on the market. It also improves financial conditions globally, encouraging risk-taking and investment in EM equities.

Chinese equity valuations have been heavily discounted over the years from poor investor confidence, ad hoc regulatory crackdowns, concerns over a potential property bubble and geopolitical tensions with the US. However, the mood of investors over China is changing. MSCI China is up 29% so far year to date in US dollar terms and its price-to earnings (PE) discount to DMs has narrowed.7

Part of a shift in investor sentiment can be traced back to viewing Chinese stocks through an AI lens. The launch of DeepSeek earlier this year, along with a growing base of domestically developed open-source AI large language models (LLMs), has led to a reassessment of where China fits into the tech chain. Unlike the US, where AI-related capital expenditure is concentrated in data centres, Graphical Processing Units (GPU), and energy infrastructure, China is focusing on self-reliance - investing in chip development, national computing networks, and AI research labs. Chinese stocks offer investors a differentiated way to gain exposure to the AI theme, and at a cheaper valuation.

China is also tackling global trade headwinds by launching ambitious infrastructure investments aimed at boosting domestic demand and reducing the risk of a sharp economic downturn. A standout example is the RMB1.2 trillion (£125 billion) Tibet hydropower project, unveiled by Premier Li Qiang on 19 July 2025.8 The facility is expected to become the largest hydropower installation in the world, with an annual output of 300 billion kilowatt-hours—more than three times that of the famed Three Gorges Dam.

With some signs of de-escalation in the US-China trade protectionism following a mutual reduction in tariffs in May, money has flowed into Chinese listed stocks in Hong Kong, which are easily accessible by international investors.

Bringing together the relative drivers discussed above, and assuming these factors hold true, our regression model suggests there is potentially room for EMs to outperform DMs by another 10% or so from here. As a firm we see compelling opportunities in EM equities and expect robust performance. As such, this remains a preferred allocation in the context of a global equity allocation.

However, there are notable risks to be mindful of:

First, given China accounts for around 30% of EM equities, what happens on the Mainland has repercussions for the asset class.9 Investor caution toward Chinese markets, largely due to perceptions of China as both an economic and geopolitical competitor to the United States, can limit the extent of how far EM equities can re-rate. Next up for investors to monitor will be the outcome of a yet unscheduled meeting between President Trump and President Xi.

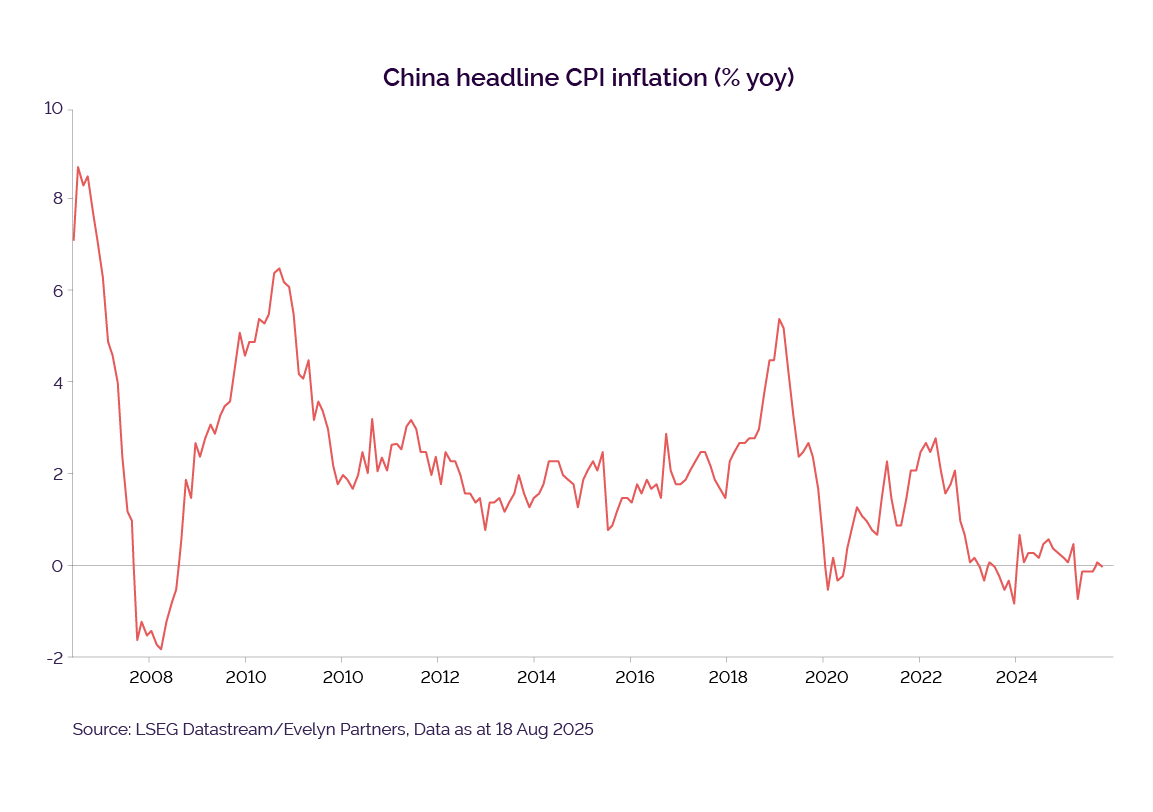

Second, concerns are compounded by ongoing deflationary pressures in China and structural imbalances, including excess capacity across multiple sectors. Investors will be looking at whether China’s economy can escape from deflation. In June, annual CPI inflation was zero in July.10 Fundamentally, investors will be looking for evidence that Chinese companies can deliver on earnings expectations, and particularly as they have a poor track record of translating economic growth into EPS.

And finally, disruption to the AI theme could well weigh on investor appetite generally and particularly for a risky asset, like EM equities. The jury is still out on whether AI can lift the productive capacity of the global economy. Since the launch of AI-powered conversational tool, Chat-GPT, in the fourth quarter of 2022, US non-farm business productivity has averaged 2.1% growth, roughly the same as the average since 1950.11

Just as the Sharks and Jets battled for dominance on the Manhattan streets of New York in West Side Story, emerging and developed markets are fighting it out for investor allocation.

1, 2, 3, 6, 7, 9, 10, 11. LSEG/Evelyn Partners

4. United Nations, World Population Prospects, 2024

5. IMF.org; Global growth expected to decelerate as trade-related distortions wane; July 2025

8. Aljazeera.com; China starts construction of world’s biggest hydropower dam in Tibet; 22 July 2025

Some of our Financial Services calls are recorded for regulatory and other purposes. Find out more about how we use your personal information in our privacy notice.

Your form has been submitted and a member of our team will get back to you as soon as possible.

Please complete this form and let us know in ‘Your Comments’ below, which areas are of primary interest. One of our experts will then call you at a convenient time.

*Your personal data will be processed by Evelyn Partners to send you emails with News Events and services in accordance with our Privacy Policy. You can unsubscribe at any time.

Your form has been successfully submitted a member of our team will get back to you as soon as possible.