AUM and asset flows update for the three months ended 30 September 2025

Evelyn Partners reports record £67.0 billion in AUM, with £2.1 billion of gross new assets in Q3 2025

Evelyn Partners reports record £67.0 billion in AUM, with £2.1 billion of gross new assets in Q3 2025

Key Highlights

Paul Geddes, Chief Executive Officer, commented:

"I am pleased to report that we closed the third quarter with a record £67.0 billion in AUM, driven by positive market movements and continued net inflows. Gross inflows reached £2.1 billion, representing an annualised rate of 12.7% and the strength of our proposition is underscored by our consistent track record of having delivered net inflows every quarter since the creation of Evelyn Partners in 2020.

We continue to support our clients through a financial landscape that is evolving with changes to tax and pensions, as well as uncertainty caused by the upcoming Budget. I am proud of, and encouraged by, the level of engagement with our clients through changing market conditions. Importantly, clients continue to turn to Evelyn Partners for trusted advice, and we remain well positioned to serve them through our Total Wealth Management service, which offers clients integrated support from both a Financial Planner and an Investment Manager.

The quarter also saw us kick off the final phase of a major system integration programme which will result in all our 600+ practitioners operating off the same industry-leading, integrated Financial Planning and Investment Management platform. The platform is live across all our UK locations, with most teams already on it including all our Financial Planners, and with the final migrations to be completed at the start of next year. The completion of this strategic project will unlock significant value, resulting in a single view of the client for both our Financial Planners and Investment Managers that will support the delivery and growth of our Total Wealth Management service. All clients will benefit from access to the same enhanced portals, and every Investment Manager will be able to utilise Aladdin Wealth, a market leading risk management and portfolio optimisation platform.

The completion of this project also lays the foundations for us to realise the transformational potential of AI, from client insights and analytics to improvements in productivity and efficiency that will free up more time for our client-facing colleagues to spend with clients. To capitalise on this, we have appointed Ben Pashley to the newly created role of Chief AI Officer, who will be joining us on 1 December to lead our AI strategy.”

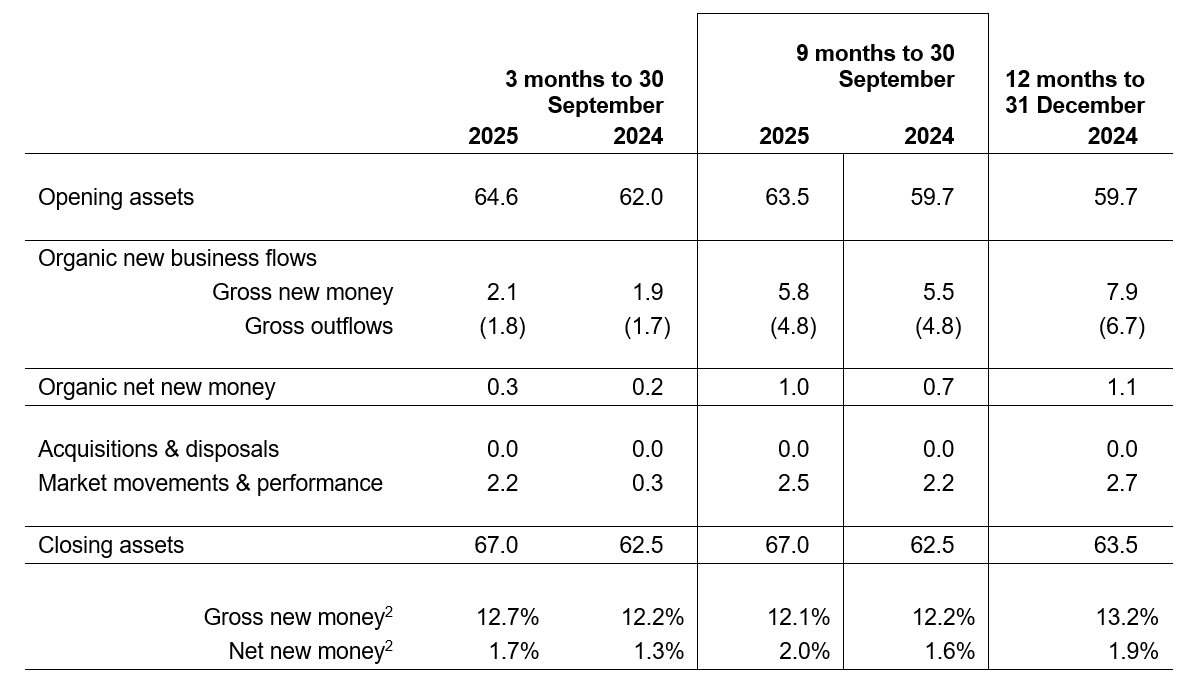

Assets under Management and Advice (£ billions)

1. Due to improved data collection, the prior period numbers presented have been restated to reflect the inclusion of AUM and flows relating to MPS assets on third-party platforms that had not previously been recognised.

2. Organic growth rate represents new money as a percentage of opening assets, then annualised.

Some of our Financial Services calls are recorded for regulatory and other purposes. Find out more about how we use your personal information in our privacy notice.

Your form has been submitted and a member of our team will get back to you as soon as possible.

Please complete this form and let us know in ‘Your Comments’ below, which areas are of primary interest. One of our experts will then call you at a convenient time.

*Your personal data will be processed by Evelyn Partners to send you emails with News Events and services in accordance with our Privacy Policy. You can unsubscribe at any time.

Your form has been successfully submitted a member of our team will get back to you as soon as possible.