Key Highlights

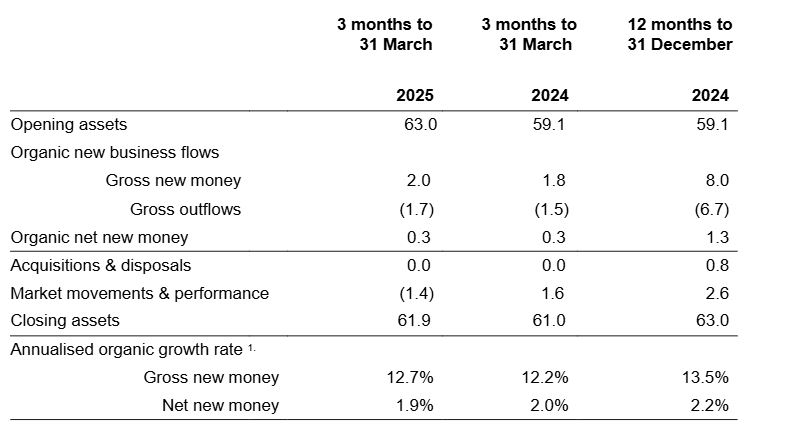

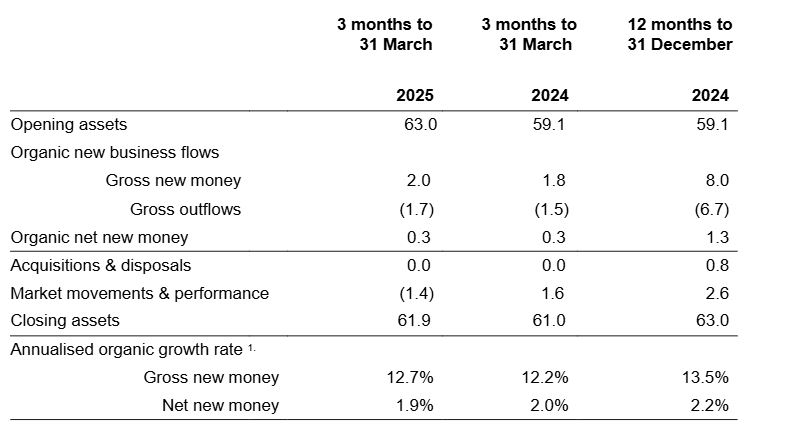

- Gross inflows of £2.0 billion in Q1 were 11.1% higher than the same quarter last year (Q1 2024: £1.8 billion), equivalent to an annualised growth rate of 12.7% based on opening assets.

- Given the macroeconomic and fiscal environment, withdrawals continued to be elevated but net flows remained positive at £345 million. This was slightly ahead of Q1 2024 (£266 million).

- AUM at 31 March was £61.9 billion (31 December 2024: £63.0 billion) reflecting the impact of adverse market movements.

- At the end of Q1 the Group successfully completed the sale of its professional services business as it strategically refocuses solely on wealth management.

Paul Geddes, Chief Executive Officer, commented:

“The first quarter marked an important milestone for us. On 27 January we announced a deal to sell our Fund Solutions arm and on 31 March we successfully completed the sale of our Professional Services business. These transactions see Evelyn Partners now focused exclusively on wealth management, supporting clients with both financial planning advice and investment management.

“In Q1 we continued to generate significant volumes of gross new money despite volatile markets, generating £2.0 billion of gross inflows. This represents an annualised rate of 12.7% and is ahead of Q1 last year. Outflows remained elevated as some clients drew down on portfolios to fund goals including paying down mortgages, paying tax bills and gifting assets. Despite this, net flows remained positive at £345 million, up from £266 million in Q1 last year. This continues our track record of consistent net inflows every quarter since Evelyn Partners was created from the merger of Tilney and Smith & Williamson in September 2020.

"Client engagement levels are very high given the combination of tax and pension changes announced at the Autumn Budget, particularly in relation to bringing unused pension assets into the scope of inheritance tax from 2027, and recent market volatility. In times of uncertainty, clients turn to us for trusted advice, and we are being very proactive in supporting them. Alongside direct contact between clients and their financial planner or investment manager, in Q1 we saw a fivefold increase in the average number of attendees at our events compared to last year and email open rates were double the industry benchmark. While portfolios have been impacted by equity market volatility, our diversified, multi-asset approach has helped clients to weather recent turbulence.”

Assets under Management and Advice (£ billions)